RESCU- A PROGRAM FOR FIRST RESPONDERS AND MILITARY SERVICE MEMBERS for Drug & Alcohol Addiction Treatment

Our substance abuse treatment program for First Responders and Military Service Members is designed based on clinical practices proven to be effective to address the specific needs of this group of professionals.

Our program offers group therapy that is tailored to address the specific obstacles encountered by first responders and military service members, including:

■ Work-related traumatic events

■ Guilt about breaking public trust

■ Depression

■ Anxiety

■ Drinking culture

■ Difficulty asking for help

■ Mistrust in mental health professionals

■ Fear of losing their jobs or pay

■ Fear of disappointing their co-workers or their departments

For our Former and Current Military Service Members

No matter when you served, the type of discharge received, or location of deployment, you deserve the highest quality treatment your country has to offer. At RCA, you will be treated with dignity in an environment that honors your service. We will provide you with the support needed to get you back to work. Brochure can be found below

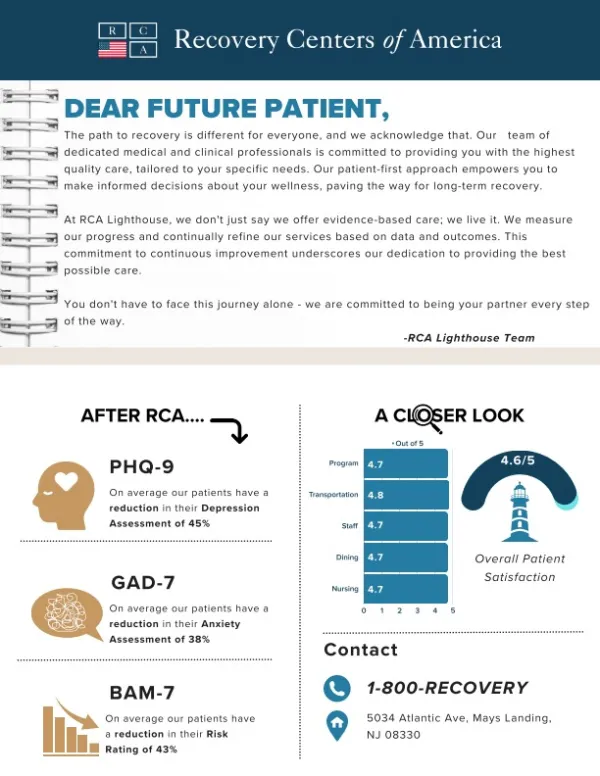

Clinically proven treatment, delivered with care.

Recovery from drug and alcohol addiction is a journey, and Recovery Centers of America is there for you every step of the way. Our full continuum of care ensures you have access to the expert care best for you, and a supportive community always.

• Medically managed withdrawal

• Residential inpatient treatment

• In-person and virtual outpatient treatment (PHP, IOP)

• Medications for addiction treatment (MAT)

• Family services

• 24/7 support

• Alumni Association support for life

Get help today with our fast and simple admissions process! We will answer any questions you may have about treatment and help you access the expert care you deserve. You are the most important person in the world to us, and we make getting the help you need simple.

• 24/7 admissions: Call us any time, day or night and we will answer the phone.

• Transportation: We will send a car to pick you up.

• In-network with most major insurance providers, and we offer interest-free

payment plans.

• Complimentary intervention support, if needed.